Not Quite A Full Bull

Not much to go on as Wednesday’s light-volume action made for a mixed bag of stock action.

With Tuesday’s Follow Through Day notched in we’ve changed our market bias to Buyer’s Caution.

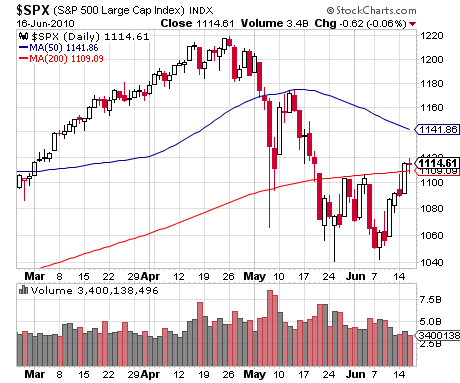

The major indexes need to show us they can hold ground above their 200-day moving averages before we become more aggressive buyers. The technical resistance obstacles of their 50-day moving averages are the next step up.

Where strong volume from the traditional bull market leadership of Semiconductors (SMH) yesterday bodes well for the market’s potential, heavy selling from the similar key sector of Retail (XRT) today is cautionary. Bullish confirmation from Finance (XLF), which remains under its 200-day moving average, is also desired before we become more bullish.

In Growth Stock action, we’re pleased to see a number of issues holding ground after breaking out of technical bases: Mercadolibre (MELI), Akamai Technologies (AKAM) Chipotle Mexican Grill (CMG) and Deckers Outdoor (DECK.)

Lulumon Athletica (LULU) and Ulta Salon Cosmetics & Fragrances (ULTA) are the most recent members to join the breakout club.

Leave a comment